Necessary Insurance for Home Health Agencies

Table of Content

Most states require workers’ comp for home healthcare services that have employees. It also protects sole proprietors from work injury costs that health insurance might deny. Home health sector is employee theft, which is one of the most common claims reported to carriers. Bonding can cover criminal activities, and in order to reduce the incidence of these activities home health care agencies should put stringent anti-theft measures into place and supervise employees carefully. A business owner's policy, or BOP, is a cost-effective way for a personal care aide to buy commercial property insurance and general liability coverage together. This company was very precise with explaining services and made sure I chose the right business insurance coverage, great customer service at purchasing.

Food and DrinkLearn about New York restaurants, bars, liquor stores commercial insurance coverages. See how food service insurance help protect against accidents, oversights and lawsuits resulting from business operations. If you have an occurrence policy, you can simply purchase the CM&F professional liability insurance policy when the policy with your current insurance provider expires. When using our online application, you are able to select your coverage date at least 30 days in advance, so you don't have to worry about coming back to apply on the exact day. Home health and assisted living facilities typically require specialized coverages for both general liability insurance and professional liability.

General Liability Insurance Quote Forms

Even if you did nothing wrong, the out-of-pocket costs for legal defense is expensive. CM&F provides comprehensive home health care group professional liability insurance that protects your business’s financial stability and reputation from the damages of lawsuits resulting from errors, negligence, or undelivered services. Additionally, CM&F’s home health care group malpractice insurance also covers the payment of any Court Award or Settlement as well as Legal Defense costs.

Errors and Omissions Insurance—This is sometimes known as director’s liability insurance. Malpractice Insurance—This is a form of liability insurance and is often included in liability insurance. While general liability insurance covers all manner of liability (e.g., causing an automobile accident), malpractice insurance is limited to clinical actions. If you have a personal umbrella liability policy, there's generally an exclusion for business-related liability.

Legal

I have shared this company information now with other business owners for their policy needs. General Liability protects your agency from claims that may arise in the normal course of operations. For example, a client visits your office on a rainy day, and slips and falls as they enter the door.

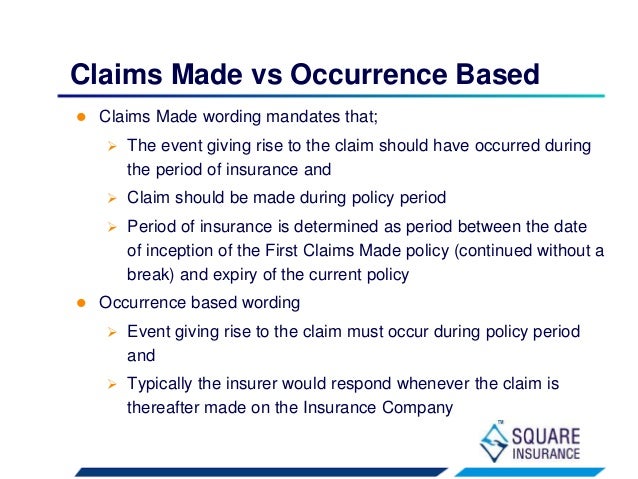

Once you submit your application, you are emailed your coverage documents in minutes – No Delay, No Headache. “Occurrence” or “claims made” refers to the type of policy coverage you’d be purchasing. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Some of this material was developed and produced by Agency Revolution to provide information on a topic that may be of interest.

Cyber Insurance for Home Health Care Business

I did not have to fill out applications, and Tricia was able to quote and bind business insurance for me within half an hour. Great service insurance prices are great for professionals looking to get insurance for businesses.... A cyber-attack could mean that your business information or even your client’s financial information is compromised. If you collect this type of information from your clients, it is the responsibility of your agency should something happen to it. As a Home Health Care Provider, you help care for and assist patients in their own homes.

On-the-job injuries can happen at any time, and working in the presence of medical devices and chemicals make for potentially serious accidents. Workers’ compensation insurance protects employees by guaranteeing financial benefits for a set duration for qualified injuries sustained while working. New Jersey requires most employers to carry workers’ comp insurance, but it is also a good idea for those outside New Jersey’s business requirements.

General Liability

Sports and FitnessLearn about New York sports & fitness insurance policies and what they cover so that your customers, employees, and equipment are protected. Education, Colleges, Universities & SchoolsLearn about New York commercial insurance for educators that helps protecting your professional reputation and other legal liabilities arising from your educational services. Children and PetsDiscover what New York commercial insurance policies cover for children and pet related businesses. Some clients might also need you to agree to a certain level of general liability before you can provide goods or services to them.

Working with elderly or disabled patients can be challenging and unpredictable. Even the most careful health professional can make a mistake, miscommunicate care instructions to others, or even become injured themselves. We are an Independent Insurance Agency, which means we have made available some of our best companies for your online quick quotes.

If for any reason an employee is accused of stealing from the workplace, the staffing agency is just as responsible as the employee for such actions. Fidelity bonds protect your business against the costs of theft and subsequent legal action. InsureYourCompany.com provides individual, scheduled and blanket bonds. Advertising, Marketing and MediaLearn about New York media liability insurance - a specialized form of professional liability insurance that provides protection for legal claims brought by third parties.

For example, while at a client’s home you accidentally knock over an antique vase. Uncover best practices for improving your patient experience that will reflect in your CAHPS scores, reviews and referrals. If the HHA is doing something that violates one or more of these statutes, then such violation will likely come to the attention of the Department of Justice and Office of Inspector General through claims analysis and/or a whistleblower. DownloadAccess your proof of coverage to share or download, instantly. QuoteView coverage options and make sure the price fits your budget. Nurses will receive directions from physicians and should follow approved procedures in all ways.

Several issues can occur when working in a patient’s home that would warrant the need for liability insurance. This policy can pay legal costs related to work performance, such as an accusation of negligence from a client's family member. He explained everything in a very clear/logical way and answered all of my questions. After providing all the information to obtain general liability insurance, Jose sent me the declaration page of the insurance for review. All of the information matched what I provided over the phone and there were no typos.

Our agency specializes in helping business owners find commercial insurance products like general liability, professional liability, property coverage, commercial auto and more. If you own or operate a home care facility and are looking for high quality, affordable liability insurance policies to protect your staff, residents, and operation as a whole, InsureMyRCFE is here to help. With InsureMyRCFE, facilities that meet all of the necessary qualifications can click, quote and bind their insurance policies online with little time and effort required.

Back injuries are common due to the mobility limitations of many home healthcare patients who require lifting or support. Unruly or unpredictable patients can cause injury or harm including strains, back injuries and contusions. The employee must be able to handle conflicts that may occur during interactions with other family members.

Comments

Post a Comment